Worthy Wealth invests in undervalued and underperforming senior living facilities, modernizes them, then sells them for a profit.

You too can invest in this $158 billion dollar growth market.

Why Invest in Senior Living?

We're seeing a massive demographic shift, with the U.S. population over 80 set to grow by 28% in the next five years. This is creating a huge demand for senior living options. What's particularly interesting is that new construction for senior housing has been at historic lows. It's a compelling picture for anyone looking at where the market is headed.

America is Aging Fast Creating Record Demand

Demand for senior housing is currently surging and is expected to continue increasing due to the large baby boomer generation entering their senior years. Over 10,000+ people turn 65 every day in the U.S. The 80+ population is projected to grow 28% by 2030 and double by 2050.

Massive Undersupply of New Construction

Construction starts are at record lows (0.8% of inventory), while demand accelerates. This imbalance gives investors rare scarcity value and strong occupancy/revenue growth potential. Current development pace is projected to result in a $275 billion supply gap by 2030, according to NIC MAP.

Seniors Have Growing Expectations for Facilities

40% of current senior living facilities are over 25 years old and are not equipped to meet the demands of today's seniors. Seniors, particularly baby boomers, have higher expectations for services, amenities, technology integration, wellness programs, and personalized experiences in senior living communities

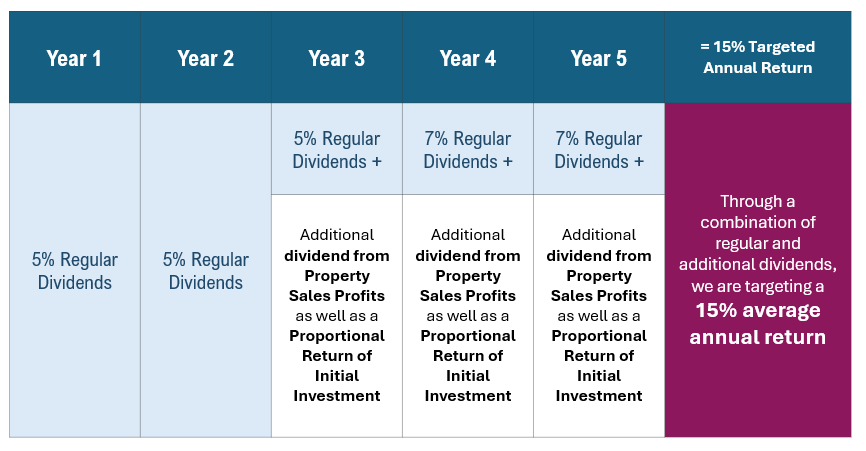

Earn a Targeted 15% Annualized Return with Senior Living Shares

How it Works

- Shares are only $10 each. Invest as little as $100 (10 shares) or as much as $50,000 (5,000 shares)

- Investments are pooled and used to purchase senior living investment properties.

- Properties are updated, modernized and resold at a profit.

- While the properties are being updated, you earn a 5% dividend in years 1-3, and 7% thereafter.

- When properties are sold, you also receive a share of the profits from each sale in addition to your principal returned.

- After profit sharing and dividends, we are targeting a 15% annualized return

Click on the video above to watch our in-depth webinar about Senior Living Shares.

Click on the button below to purchase Worthy Wealth Senior Living Shares

More Information and Additional Resources

- Investment Type: Shares of preferred equity

- Target Yield: 15% net annualized

- Investment Levels: Minimum $100 (10 shares), Maximum $50,000 (5,000 shares)

- Target Term: 5 Years

- Dividend Payment Schedule: Quarterly 5% yrs 1,2,3 and 7% thereafter. First year dividend will be accrued and paid on or about May 5, 2026, then all dividends will be paid quarterly thereafter

- Profit Dividend Payment Schedule: Your percentage of the profits (based on # of shares you hold) from the sale of properties will be disbursed when each facility is sold.

- Proration: Dividends will be prorated based on the holding period (number of days) for each preferred shareholder.