Why Invest With Worthy Wealth?

Worthy Wealth Makes It Easy to Save and Invest

Worthy combines a financial product (high yielding, interest bearing securities) with an inventive delivery tool (a round-up app) making it easy for anyone to save and invest.

Worthy bonds are one of the few, higher-yielding financial products open to the retail investor that supports "Main Street" not Wall Street - therefore offering a social return in addition to a financial one.

Additionally, unlike most other investing apps, we own the underlying financial vehicle, the Worthy bond. This is a proprietary product that we engineered and are in the process of qualifying for sale with the SEC so this provides a bit of a barrier to entry to other competitors given the complex federal and state regulatory qualification process.

We will also use a proprietary technology platform for handling the digital bond management and sales which adds additional value to our venture.

As we expand our offerings, services, number of registered users, and number of bondholders (all expected to increase our enterprise value), we will continue to explore alternative sources of liquidity for our shareholders. Management intends to pursue an exit strategy that maximizes shareholder value which could include either an initial public offering or acquisition by a larger company.

Other Great Reasons to Choose Worthy Wealth

Affordable for Everyone

Worthy Wealth bonds start at only $10 each. That's about the same as a coffee and a muffin.

Painlessly Save With Round Ups

Large Market Potential

Generous Interest

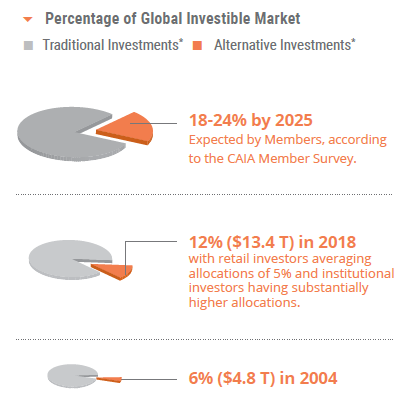

Alternative Investments Go Mainstream

Alternative investments are rapidly moving into the mainstream. Retail investors, confronted with volatile financial markets and the underfunding of their own retirements, are now following the path blazed by wealthy individuals and institutional investors in seeking a better financial return. These classes of investors had access to a variety of higher-yielding, investment opportunities then the masses were allowed to have - such as stock in growing private companies and lending money to private, creditworthy businesses or developers. This changed with the passing of The JOBS ACT in 2012, which altered long-standing securities laws and opened up these types of alternative investments for the rest of us.

Fueled in part by these new laws, a distrust of old guard financial institutions, and investors growing desire to have their money make a social impact, we believe both borrowers and investors are flocking to alternative, and more community focused, financial products to meet their capital needs and to diversify their portfolios. A study by State Street, indicates a continuing trend of shifting from public markets to private assets within portfolio allocations. More than a third of institutions (36 percent) have already allocated over half of their portfolio to private market investments, a number expected to rise to 41 percent within the next three to five years. Additionally, 59 percent of institutions have allocated at least 30 percent to private markets, with projections reaching 71 percent by 2028. Worthy is already playing a part in this historical shift towards private market investment opportunities.

Bottom line is we believe the 98% need access to higher yields and a more stable financial return and Worthy creates products to help.

Why Alternative Investments Are Worthy

According to most investment advisors, one of the important rules of portfolio management is to combine assets that make money independently and don't correlate with one another. Having investments in areas that react differently to the same event (such as a political development or a global pandemic) can balance an investor's risk and protect against loss.

According to most investment advisors, one of the important rules of portfolio management is to combine assets that make money independently and don't correlate with one another. Having investments in areas that react differently to the same event (such as a political development or a global pandemic) can balance an investor's risk and protect against loss.

Investors Need Diversification

A blended portfolio of traditional (such as stocks) and alternative investments (such as real estate, precious meals, private lending, etc) can offer benefits in performance and a reduction in volatility.Portfolios Need Non-Correlation

To protect from market swings, investors need assets in their portfolios that don't directly correlate to movements in traditional investments such as stocks and ETF's.Since diversifying investments across asset classes can improve your chances of not losing your money, Worthy's fixed interest bonds can be an attractive addition to a diverse portfolio.